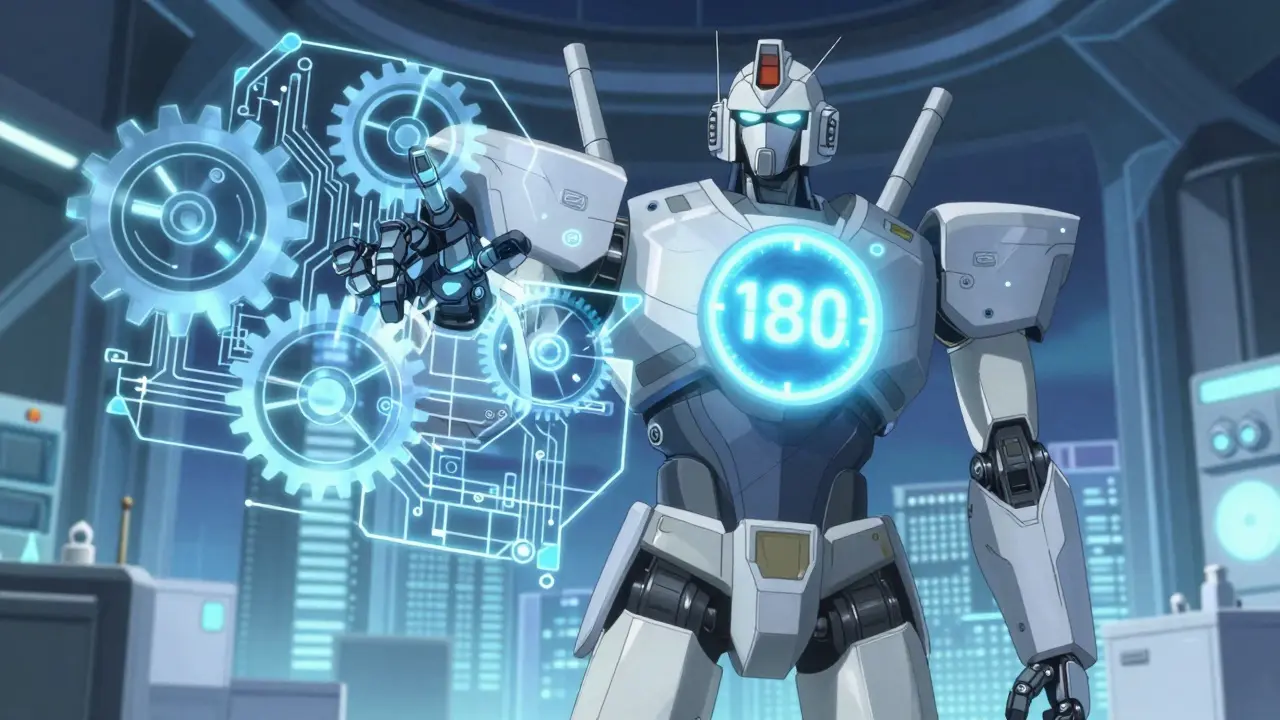

First Generic Approval is a key regulatory milestone that transforms how patients access affordable medications. When the U.S. Food and Drug Administration (FDA) grants this status to a generic drug manufacturer, it unlocks exclusive rights to sell the generic version for 180 days. This process, created by the Hatch-Waxman Act of 1984, has saved Americans over $1.7 trillion in healthcare costs since its inception.

What Exactly is First Generic Approval?

First Generic Approval is the FDA's designation for the first company to successfully submit an Abbreviated New Drug Application (ANDA) for a generic version of a brand-name drug. Unlike the old system before 1984, generic manufacturers no longer need to repeat costly clinical trials. Instead, they prove bioequivalence to the original drug. This streamlined process allows generics to reach the market faster and cheaper.

The key to this approval is the Hatch-Waxman Act, which balances innovation incentives with generic competition. Under this law, companies that file an ANDA with a Paragraph IV certification (challenging a patent) can earn 180 days of market exclusivity. During this window, they're the only generic competitor, allowing them to capture 70-80% of the market share before other generics enter.

How the Approval Process Works

Getting First Generic Approval isn't simple. It starts with an ANDA submission that must be "substantially complete"-meaning all required data is included without major gaps. The FDA then reviews the application. For bioequivalence, the generic drug must match the brand-name drug in how the body absorbs it. Specifically, the 90% confidence interval for the drug's exposure (AUC) and peak concentration (Cmax) must fall between 80% and 125% of the brand-name drug's values.

Between 1996 and 2007, the FDA studied 2,070 comparisons between brand and generic drugs. The average difference in absorption was just 3.5%, similar to variations between two batches of the same brand-name drug. This shows generics are consistently safe and effective.

If the generic company challenges a patent via Paragraph IV certification, the brand-name manufacturer has 45 days to sue. This triggers a 30-month stay, delaying FDA approval while courts decide. If the generic wins, they get the exclusivity period. If not, they lose the chance for exclusivity.

Why First Generic Approval Matters

The impact of First Generic Approval is massive. In 2023, generics filled 90% of U.S. prescriptions but accounted for only 10% of total drug spending. This shift has saved the healthcare system over $1.7 trillion since 1984. For blockbuster drugs like Humira, the first generic entry slashed prices by 70-90% within six months. Before the generic, Humira cost over $70,000 per year; the first generic version dropped it to under $10,000.

Pharmacists report 87% of patients experience better access to medications after a first generic launch. A 2024 survey of 1,200 pharmacists found 73% saw improved medication adherence among patients switching to generics. This isn't just about cost-patients get the same therapeutic outcomes at a fraction of the price.

But it's not all smooth sailing. Sometimes, multiple companies file for First Generic Approval simultaneously. In 10.6% of cases from 2001-2022, this led to shared exclusivity, diluting the financial reward. Brand-name manufacturers also sometimes release "authorized generics"-their own unbranded version-which can enter the market during the exclusivity period, eating into the first generic's profits.

Market Impact and Economic Benefits

First generic approvals drive massive savings across the healthcare system. The Congressional Budget Office estimated the Hatch-Waxman framework saves $13 billion annually in U.S. healthcare costs. For drugs with annual sales over $1 billion, the first generic entrant can capture $100-$500 million in profits during the 180-day exclusivity window by pricing 15-20% below the brand-name drug.

Teval, a leading generic manufacturer, secured 14 first generic approvals in 2023 alone. Their success highlights how companies strategically target high-value drugs. Meanwhile, Hikma Pharmaceuticals earned 11 first generic approvals in the same year, focusing on complex injectables. These companies play a critical role in making medications affordable.

However, challenges persist. Patent thickets-where brand-name manufacturers file multiple overlapping patents-delay generic entry in 42% of cases between 2010-2020. Dr. Aaron Kesselheim of Harvard Medical School notes this tactic creates "perverse incentives" for brand-name companies to extend monopolies. Despite these hurdles, first generics remain the most effective tool for reducing drug costs.

Current Trends and Future Outlook

The landscape is evolving. The FDA's 2023 guidance on complex generics has sped up approvals for difficult-to-copy drugs like inhalers and topical creams. The Inflation Reduction Act of 2022 also changed the game by eliminating the 180-day exclusivity clock stop for drugs with Risk Evaluation and Mitigation Strategies (REMS). This means the exclusivity period can't be paused for REMS-related issues, pushing faster generic entry.

Looking ahead, Evaluate Pharma projects an 8.3% annual increase in first generic approvals through 2028. This growth is driven by $156 billion worth of branded drugs set to lose patent protection. However, biologics remain a challenge. The Biosimilars pathway created in 2010 has only yielded 43 approvals by 2023 due to scientific complexity. FDA Commissioner Robert Califf emphasized in January 2024 that accelerating first generic competition remains the most effective tool for reducing prescription drug costs.

Frequently Asked Questions

What is the Hatch-Waxman Act?

The Hatch-Waxman Act, formally the Drug Price Competition and Patent Term Restoration Act of 1984, is a U.S. law that created the modern generic drug approval system. It balanced innovation incentives for brand-name drugmakers with faster access to affordable generics. Key provisions include the Abbreviated New Drug Application (ANDA) pathway and 180-day market exclusivity for first generic filers.

How long does the FDA take to approve a first generic?

The FDA typically reviews first generic applications in 10-12 months, compared to 14-18 months for standard generic approvals. This accelerated timeline is due to the priority given to first-to-file applications. However, patent litigation can extend this period by up to 30 months if the brand-name manufacturer sues.

Can multiple companies get first generic approval?

Yes. Approximately 10.6% of first generic approvals between 2001 and 2022 involved multiple filers. In these cases, the FDA grants shared exclusivity, meaning all qualifying applicants split the 180-day marketing window. However, this reduces the financial reward for each company compared to sole exclusivity.

What is bioequivalence testing for generics?

Bioequivalence testing compares how the body absorbs a generic drug versus the brand-name version. The FDA requires the 90% confidence interval for the drug's total exposure (AUC) and peak concentration (Cmax) to fall between 80% and 125% of the brand-name drug. Studies show the average difference in absorption is just 3.5%, making generics as safe and effective as brand-name drugs.

Why do brand-name companies sometimes release authorized generics?

Authorized generics are brand-name drugs sold without branding by the original manufacturer. Companies do this to compete with first generics during the exclusivity period. Between 2015-2022, authorized generics entered the market during 38% of first generic exclusivity windows. This strategy can erode the first generic's market share by 20-30%, reducing potential profits for the generic company.

Danielle Vila

February 6, 2026 AT 15:28Ah, the FDA's 'First Generic Approval'-what a shiny facade! Big Pharma and the government are in cahoots to keep drug prices sky-high under the guise of 'innovation'! They're using this Hatch-Waxman Act as a smokescreen while they milk patients dry.

I've seen the numbers, and let me tell you, it's all a rigged game. The 180-day exclusivity? More like a pay-to-play scheme for the big players. And don't get me started on the 'bioequivalence' testing-it's a joke! The FDA's own studies show variations that should disqualify half of these generics.

It's all smoke and mirrors to keep us paying for overpriced meds while they line their pockets. Wake up, people! This isn't about saving money-it's about control. The real story? The FDA is just a puppet for the pharmaceutical lobby. They don't care about patients; they care about profits. It's time to expose the truth! Did you know that some generics are manufactured in the same facilities as brand-name drugs? Yet they're sold at a fraction of the cost. That's the real scandal here. The system is designed to favor corporations over people.

Thorben Westerhuys

February 7, 2026 AT 15:37Wow! This is just incredible! The FDA's approval process is so complex and nuanced! I mean, have you thought about how this impacts everyday people? It's just heart-wrenching! I feel so emotional about this! The amount of money saved is astronomical! 1.7 trillion dollars! That's mind-blowing! But the side effects are concerning! We must ensure the generics are safe! This needs more scrutiny! It's just too important to not question thoroughly! Oh my goodness! This could be life or death for so many people!

Dr. Sara Harowitz

February 7, 2026 AT 23:55America leads the world in pharmaceutical innovation! This 'First Generic Approval' is a threat to our nation's health! We must not allow foreign companies to undercut our domestic industry! The FDA is failing to protect American jobs! This system is a disaster for national security! We need to stop this immediately! It's shameful! The United States deserves better! This is a betrayal of our hardworking scientists! How dare they?! We must act now!

Jenna Elliott

February 9, 2026 AT 05:01This is all about profits nothing else

Laissa Peixoto

February 9, 2026 AT 17:59The Hatch-Waxman Act has indeed revolutionized access to medications. However, it's crucial to consider the balance between innovation and affordability. While generics reduce costs significantly, we must ensure that the quality isn't compromised. The data shows that bioequivalence is generally maintained, but there are nuances. For example, some complex drugs require more rigorous testing. It's a delicate balance that requires ongoing attention. We should support policies that encourage both innovation and accessibility without sacrificing safety.

Matthew Morales

February 11, 2026 AT 13:01hey guys! this is awesome! generecs save so much money! i love how they're making meds afforadable! 🤩 it's a win-win for everyone! hope the FDA keeps up the good work! 😊

Johanna Pan

February 13, 2026 AT 10:13this is such a positve development! generics make healthcare more acessible worldwide. it's important to celebrate the progress we've made. even though there are challenges, the overall impact is tremendous. let's keep working together to improve access for all. 🌍

Brendan Ferguson

February 14, 2026 AT 01:12First Generic Approval is a great example of how policy can work for the public good. It's important to recognize the savings-$1.7 trillion is massive. But we also need to address challenges like patent thickets. Collaboration between stakeholders is key. Let's keep pushing for solutions that benefit everyone.